Understanding CEBA Loan Forgiveness: What You Need to Know

The Canada Emergency Business Account (CEBA) loan was introduced by the Canadian government to provide financial relief to businesses impacted by the COVID-19 pandemic. This loan program aimed to help businesses cover their operating expenses and navigate the challenging economic landscape caused by the pandemic. One of the most significant aspects of CEBA is its forgiveness feature, which can provide substantial relief to eligible borrowers. In this blog, we’ll delve into the details of CEBA loan forgiveness and explore how much of the loan is forgivable.

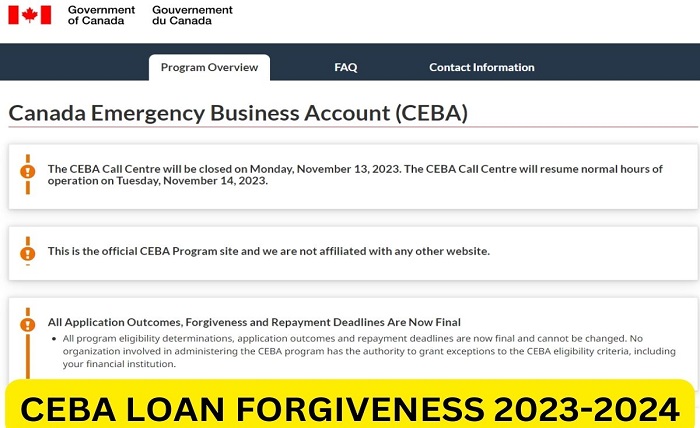

CEBA Overview

The Canada Emergency Business Account (CEBA) is a government-backed financial aid program designed to support small and medium-sized businesses facing economic hardship during the COVID-19 pandemic. It was first introduced in March 2020 and has undergone several updates and changes to adapt to the evolving situation.

CEBA offers businesses interest-free loans of up to $60,000, with an initial disbursement of $40,000 and an additional $20,000 available to those who meet certain eligibility criteria. While the initial loan amount may seem significant, it’s important to understand that not all of it is forgivable.

CEBA Loan Forgiveness

The concept of CEBA loan forgiveness is a crucial aspect of the program, as it allows businesses to reduce their loan obligation significantly, if not entirely. However, it’s essential to recognize that not all of the CEBA loan amount is forgivable. The forgivable portion is subject to specific conditions and requirements.

Eligibility Requirements

To be eligible for CEBA loan forgiveness, businesses must meet specific criteria, including:

a. Repaying the loan on time:

To qualify for loan forgiveness, the borrower must repay the loan by the specified deadlines. This deadline is typically December 31, 2022. This means that if the loan is repaid in full by this date, a significant portion of it will be forgivable.

b. Using the funds appropriately:

CEBA funds must be used for eligible expenses, such as operating costs and expenses that cannot be deferred. Ensuring that the funds are used for the right purposes is vital for loan forgiveness.

c. Demonstrating financial hardship:

Borrowers must be able to demonstrate that they have experienced financial hardship due to the pandemic. This may involve providing financial statements and other relevant documentation.

Forgivable Portion

The forgivable portion of the CEBA loan is $20,000, which accounts for one-third of the total loan amount. This means that, if all eligibility criteria are met, a business can expect to have one-third of the loan amount forgiven.

For example, if a business received the maximum CEBA loan of $60,000, $20,000 of that amount is forgivable if the business meets all the requirements. This portion of the loan does not need to be repaid, effectively reducing the overall loan obligation.

Repayment Deadlines

The deadlines for repaying the CEBA loan play a crucial role in determining the amount that can be forgiven. As of my knowledge cutoff date in January 2022, businesses had until December 31, 2022, to repay the loan in full if they wanted to take advantage of the $20,000 forgiveness feature. However, it’s essential to verify whether this deadline has been extended or modified, as government programs can evolve over time.

Impact of CEBA Loan Forgiveness

CEBA loan forgiveness can have a significant positive impact on businesses that have been struggling due to the economic challenges brought on by the COVID-19 pandemic. Here are some key advantages of CEBA loan forgiveness:

Financial Relief:

Forgiving a portion of the loan helps businesses reduce their debt burden and improve their financial position. This can be especially beneficial for small and medium-sized enterprises (SMEs) that may be facing cash flow challenges.

Lower Interest Costs:

Since the forgiven portion of the CEBA loan does not need to be repaid, businesses can avoid paying interest on that portion. This can save businesses money in interest costs.

Enhanced Sustainability:

The forgiven funds can be reinvested into the business to cover essential operating expenses, invest in growth, or simply boost working capital. This can contribute to the overall sustainability and resilience of the business.

It’s important to remember that CEBA loan forgiveness is not automatic. Businesses must proactively meet the eligibility criteria and repay the loan on time to benefit from this feature. Failure to meet the requirements could result in the loan not being forgiven, and the business would need to repay the full loan amount.

Conclusion

The Canada Emergency Business Account (CEBA) loan program has been a lifeline for many businesses during the COVID-19 pandemic. Its forgiveness feature, which allows businesses to have a portion of the loan forgiven, is a crucial aspect of the program. As of my last knowledge update in January 2022, $20,000 of the CEBA loan amount is forgivable, provided that businesses meet specific eligibility criteria and repay the loan on time.

For businesses that have been financially impacted by the pandemic, CEBA loan forgiveness can provide much-needed relief and support. However, it’s essential for borrowers to stay informed about any changes in program requirements, deadlines, and conditions. To maximize the benefits of CEBA loan forgiveness, businesses should use the funds appropriately, demonstrate financial hardship, and meet all program requirements.

As the economic situation continues to evolve, it’s advisable for businesses to consult with financial advisors, accountants, or government authorities for the most up-to-date information on CEBA and its forgiveness provisions. Loan forgiveness can be a valuable tool for businesses striving to recover and thrive in a post-pandemic world.